Key Insights

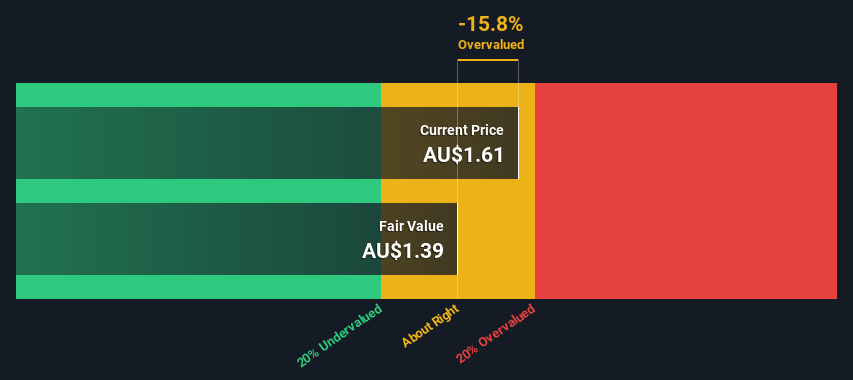

- West African Sources’ estimated honest worth is AU$1.39 based mostly on Dividend Low cost Mannequin

- With AU$1.61 share value, West African Sources seems to be buying and selling near its estimated honest worth

- When in comparison with thebusiness common low cost of -15%, West African Sources’ rivals appear to be buying and selling at a lesser premium to honest worth

As we speak we’ll do a easy run via of a valuation methodology used to estimate the attractiveness of West African Sources Restricted (ASX:WAF) as an funding alternative by taking the forecast future money flows of the corporate and discounting them again to in the present day’s worth. We’ll use the Discounted Money Movement (DCF) mannequin on this event. There’s actually not all that a lot to it, though it’d seem fairly complicated.

We might warning that there are a lot of methods of valuing an organization and, just like the DCF, every method has benefits and downsides in sure eventualities. For individuals who are eager learners of fairness evaluation, the Merely Wall St evaluation mannequin right here could also be one thing of curiosity to you.

See our newest evaluation for West African Sources

Is West African Sources Pretty Valued?

As West African Sources operates within the metals and mining sector, we have to calculate the intrinsic worth barely in another way. As a substitute of utilizing free money flows, that are onerous to estimate and sometimes not reported by analysts on this business, dividends per share (DPS) funds are used. Except an organization pays out nearly all of its FCF as a dividend, this methodology will sometimes underestimate the worth of the inventory. We use the Gordon Development Mannequin, which assumes dividend will develop into perpetuity at a charge that may be sustained. The dividend is anticipated to develop at an annual progress charge equal to the 5-year common of the 10-year authorities bond yield of two.3%. We then low cost this determine to in the present day’s worth at a price of fairness of 8.3%. In comparison with the present share value of AU$1.6, the corporate seems round honest worth on the time of writing. Keep in mind although, that that is simply an approximate valuation, and like several complicated system – rubbish in, rubbish out.

Worth Per Share = Anticipated Dividend Per Share / (Low cost Fee – Perpetual Development Fee)

= AU$0.08 / (8.3% – 2.3%)

= AU$1.4

The Assumptions

Now crucial inputs to a reduced money circulation are the low cost charge, and naturally, the precise money flows. You do not have to agree with these inputs, I like to recommend redoing the calculations your self and taking part in with them. The DCF additionally doesn’t take into account the doable cyclicality of an business, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. On condition that we’re taking a look at West African Sources as potential shareholders, the price of fairness is used because the low cost charge, slightly than the price of capital (or weighted common value of capital, WACC) which accounts for debt. On this calculation we have used 8.3%, which is predicated on a levered beta of 1.313. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the business common beta of worldwide comparable firms, with an imposed restrict between 0.8 and a couple of.0, which is an inexpensive vary for a steady enterprise.

SWOT Evaluation for West African Sources

- Debt isn’t considered as a danger.

- Earnings declined over the previous 12 months.

- Annual earnings are forecast to develop quicker than the Australian market.

- Good worth based mostly on P/E ratio in comparison with estimated Honest P/E ratio.

- No obvious threats seen for WAF.

Wanting Forward:

Though the valuation of an organization is necessary, it ideally will not be the only piece of study you scrutinize for an organization. The DCF mannequin isn’t an ideal inventory valuation device. As a substitute the very best use for a DCF mannequin is to check sure assumptions and theories to see if they might result in the corporate being undervalued or overvalued. For example, if the terminal worth progress charge is adjusted barely, it will probably dramatically alter the general end result. For West African Sources, we have put collectively three necessary components you need to discover:

- Dangers: For example, we have discovered 2 warning indicators for West African Sources (1 cannot be ignored!) that you could take into account earlier than investing right here.

- Future Earnings: How does WAF’s progress charge evaluate to its friends and the broader market? Dig deeper into the analyst consensus quantity for the upcoming years by interacting with our free analyst progress expectation chart.

- Different Strong Companies: Low debt, excessive returns on fairness and good previous efficiency are basic to a robust enterprise. Why not discover our interactive listing of shares with strong enterprise fundamentals to see if there are different firms you might not have thought-about!

PS. Merely Wall St updates its DCF calculation for each Australian inventory every single day, so if you wish to discover the intrinsic worth of every other inventory simply search right here.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not West African Sources is doubtlessly over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not West African Sources is doubtlessly over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team@simplywallst.com