I lately wrote about how Qatar Airways is planning on investing in two airways in Africa, in an effort to enhance its community there. We all know that Qatar Airways intends to put money into RwandAir, as Qatar’s authorities additionally owns a majority stake within the nation’s new worldwide airport.

Nonetheless, up till now, we may solely speculate as to what the opposite airline is. Nicely, now we all know, as reported by the Monetary Occasions.

Qatar Airways nears Airlink funding

Qatar Airways is reportedly closing in on a deal to purchase a stake in Airlink, which is South Africa’s largest regional airline. Whereas no ultimate deal has been reached, the 2 events are apparently very near an settlement.

Qatar Airways CEO Badr Mohammed Al Meer has repeatedly mentioned that southern Africa is the “lacking a part of the equation” within the service’s world route community, because the airline hopes to spice up regional connectivity.

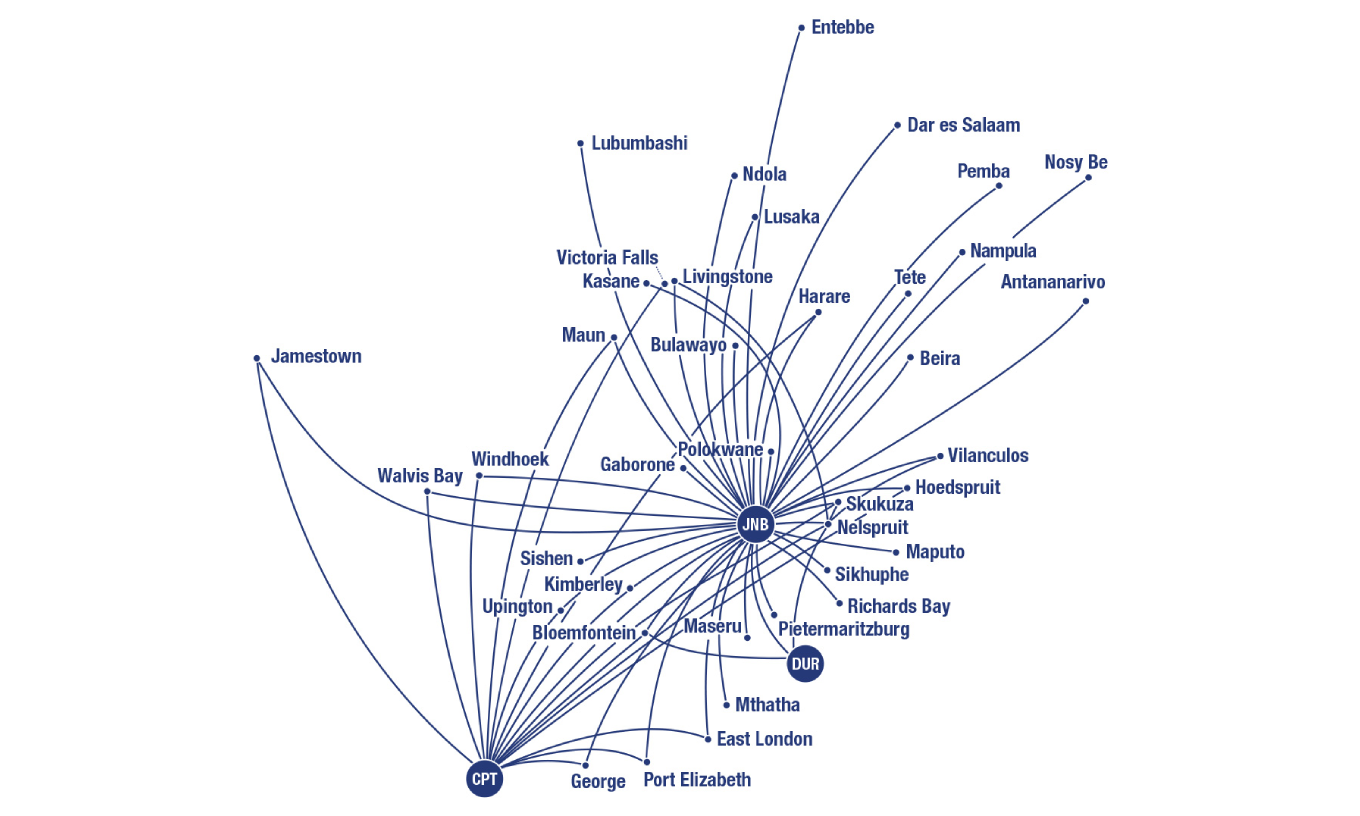

For these not accustomed to Airlink, the airline operates a fleet of roughly 65 regional jets, starting from the Embraer E135 to the Embraer E195. The airline flies to 45 locations in 15 nations in sub-Saharan Africa. The airline can also be worthwhile, which is sort of an accomplishment for the area, given what number of airways there are persevering with to maintain losses.

As you’d count on, although, Qatar Airways’ motivation to put money into Airlink is primarily strategic, and never monetary, and is meant to broaden Qatar Airways’ attain within the area. The purpose could be to ship advantages when it comes to elevated visitors, broader and deeper market attain, decrease distribution prices, and higher financing alternatives when ordering plane.

The one problem is that South Africa’s air licensing guidelines stipulate that worldwide airways primarily based in South Africa have to be “considerably” owned by residents. So clearly Qatar Airways couldn’t take full possession of the airline, however fairly must be a accomplice.

What may this funding appear like?

Normally I’m actually skeptical of airways investing in different airways, particularly once we’re speaking about Gulf carriers. I imply, Etihad’s monitor file of investing in airways is comically unhealthy, to the purpose that it could’ve been extra environment friendly to only throw billions of {dollars} right into a furnace. In the meantime Qatar Airways’ Air Italy funding a number of years again ended up in liquidation for the airline.

What do I make of this potential funding? I assume my first query is what Qatar Airways would actually acquire by investing in Airlink, fairly than simply persevering with to accomplice with the airline? The airways have already got a codeshare settlement, so Qatar Airways can get visitors from Airlink.

I believe a part of the motivation could also be to higher optimize Airlink’s schedule to tie into Qatar Airways’ route community. And maybe the purpose can also be to broaden Airlink, with Qatar Airways offering financing of newer and bigger plane.

On the identical time, Airlink is at present worthwhile exactly as a result of the corporate is so conservative and measured with its progress. The airline is concentrated on having a sustainable enterprise mannequin, fairly than on being flashy.

For instance, Airlink’s common fleet age is almost 18 years previous. Whereas newer era jets would supply higher economics when it comes to gasoline burn, it could be considerably dearer to function them.

Is the purpose to only have Airlink enhance feed to Qatar Airways’ gateways in southern Africa? Or may the purpose be for Airlink to get planes that may fly to Doha, after which join into Qatar Airways’ community?

I’m very curious to see how this performs out, because it may go a number of totally different instructions. As I’ve mentioned a number of occasions, I’m very impressed by Qatar Airways’ new CEO. Al Meer appears motivated not by status or ego for his nationwide service, however fairly by operating a great enterprise. So I definitely have much more religion in an funding that he indicators off on than another former Gulf area executives.

Backside line

Qatar Airways is reportedly nearing a deal to put money into Airlink, South Africa’s largest regional airline. Whereas Qatar Airways already has a partnership with Airlink, it appears the purpose is to strengthen that even additional.

I’d be fascinated to see what a deal seems like. Airlink has truly been fairly constantly worthwhile, exactly as a result of the airline has been so conservative with its fleet, community, and many others. I ponder how an funding may change the service’s technique.

What do you make of the prospect of Qatar Airways investing in Airlink?